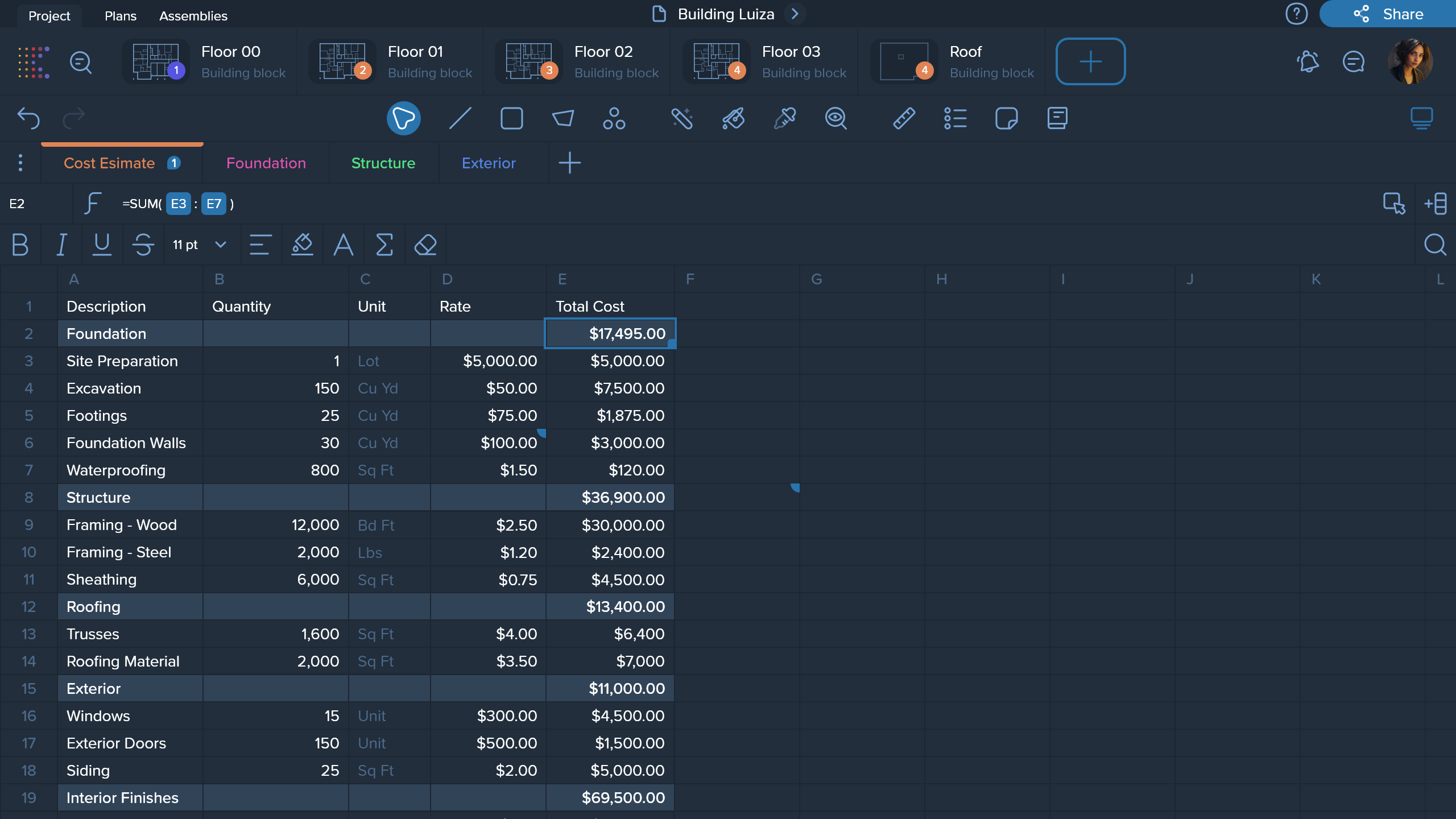

AI-powered construction software offers cloud-based takeoff and estimating, flexible reporting, and an intuitive interface, streamlining processes and improving accuracy and collaboration

Get StartedEnsures continuous and fast data processing, even when working with large-scale projects

Supports effective collaboration and real-time data sharing among project participants

Guarantees a high level of security and data confidentiality through modern encryption methods

Supports operation on various operating systems, including Windows, Apple, and Linux

Machine learning is utilized to lessen the manual effort required in counting and measuring tasks

This solution streamlines data management, supports better decision-making, and improves overall project management effectiveness, catering to the evolving needs of your business

With Kreo, collaboration in projects reaches new heights. Our platform offers unique opportunities for teamwork, making the process of planning and executing projects more efficient and intuitively understandable. Invite colleagues to projects, work together in real-time, exchange ideas and opinions directly during the work

Facilitate team collaboration for concurrent work and active involvement

Facilitate discussions, comments, and colleague tagging for idea exchange

Ensure prompt alerts on tags and project changes

Efficiently handle remarks and requests, marking them resolved post-settlement

Set up your templates once and develop an extensive database of materials, components, prices, and measurement rules. This allows you to transform measurements into cost estimates and other financial documents with just a few clicks

Create one-time templates for efficient materials and components database management

Customize tools such as properties,items and assemblies to enhance efficiency and productivity

Upload PDF or CAD files, set the scale, and start measuring

Measure drawings manually or use AI to speed up quantity acquisition

Receive your result in any format that suits you

Monthly

Annually SAVE 11%

There are no obligations. Cancel at any time.

Prices displayed in currencies other than British pounds sterling are approximate and may vary depending on the exchange rate at the time of the transaction.

Trusted by a variety of construction companies

Our customers love what we do!

.png)